Fca Aml Fines 2020

The idea of cash laundering is essential to be understood for those working in the financial sector. It is a process by which dirty cash is transformed into clear cash. The sources of the cash in precise are criminal and the cash is invested in a approach that makes it seem like clean cash and hide the identification of the prison part of the money earned.

While executing the financial transactions and establishing relationship with the new customers or sustaining current prospects the responsibility of adopting enough measures lie on each one who is a part of the group. The identification of such component to start with is straightforward to deal with instead realizing and encountering such conditions in a while in the transaction stage. The central financial institution in any nation supplies full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously provide enough safety to the banks to deter such situations.

We imposed a Fine. FCA fined the Standard Chartered Bank Standard Chartered 102163200 for Anti-Money Laundering AML failures in two high-risk business areas.

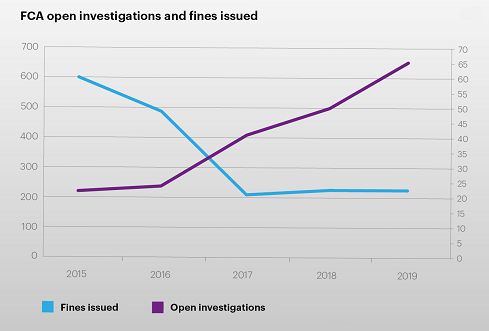

Uk Watchdog S Fines Against Insurers Banks Drop By 75 In 2018

Standard Chartered took advantage of a.

Fca aml fines 2020. The settlement was made by the bank with Malaysia against the Wall Street. The fine is one of the largest handed out by the regulator in relation to money-laundering failures. A month later the UKs Financial Conduct Authority FCA fined the Commerzbank London branch for 378 million as a penalty for failing to comply with state AML procedures.

In total these financial institutions were fined roughly 3224875 355 billion USD and 2615333831 GBP. Ad AML coverage from every angle. Latest news reports from the medical literature videos from the experts and more.

In 2019 global financial authorities handed down an unprecedented amount of money laundering fines amounting to around 814 billion including fines imposed for historic offences. In June of 2020 the Swedish Financial Supervisory Authority FSA fined the SEB bank conglomerate for 1 billion Swedish krona approx. Latest news reports from the medical literature videos from the experts and more.

When we examine some of the data announced in 2020 we see that the AML penalties given in the first half of 2020 are close to 6 billion dollars. This page contains information about enforcement fines published during the calendar year ending 2021. We have fined the firm 873118.

In the first half of 2020 only four cases have resulted in a fine but collectively those fines. Goldman Sachs Tops the List The US was ranked number 1 with the highest number of bank fines enforced in 2020. Regulators from 14 countries issued AML related fines in 2020.

The FCA has today fined Commerzbank AG London Branch 37805400 for failing to put adequate anti-money laundering AML systems and controls in place between October 2012 and September 2017. This Final Notice refers to breaches of PRIN 2 and PRIN 3 related to the risk of financial crime in the trading firms sector. FCA fines Commerzbank London 378 million for AML violations The UKs financial regulator the Financial Conduct Authority FCA fined the Commerzbank London branch 378 million for violations of AML controls.

12 cases of AML non-compliance were reported and the sum of all these fines was 939 billion. The fine on Goldman Sachs alone was 330 billion. FCA fines Standard Chartered Bank 1022 million for poor AML controls.

The total amount of fines so far is 298800. The fine will add to the financial pressure on Commerzbank which hopes to lower costs after sustaining pre-tax losses of 227 million 203 million in the first three months of 2020. In 2019 the FCA registered nearly 400 million in fines for compliance breaches and despite the pandemic investigators are striking out high and fast against non-compliance.

Press Releases First published. In total 28 financial institutions were issued fines for AML related violations in 2020. Standard Chartered was fined 102m by the FCA in April 2019 for similar issues although that.

Standard Chartered Bank AML Fines. Some of the reasons for the AML fines are due to deficiencies in the Know Your Customer Customer Due Diligence and. Ad AML coverage from every angle.

107 million for failing. Here is a summary of fines imposed in 2020. This Final Notice refers to Asia Research and Capital Managements failure to notify the FCA and disclose to the public its net short position in Premier Oil in breach of short selling disclosure rules.

In its latest review of global authorities enforcement actions consultancy Duff Phelps found that AML fines in the initial six months of 2020 reached a total of 706m compared with last years. Q3 2020 saw the highest total of fines with 1196499200 USD and 863106109 GBP. 12 rows 14102020.

The Financial Conduct Authority FCA has fined Standard Chartered Bank Standard Chartered 102163200 for Anti-Money Laundering AML breaches in two higher risk areas of its business.

Fca Fines Lbgi 90 Million For Failures In Communications For Home Insurance Renewals Between 2009 And 2017 Fca

Record Breaking Fines On Banks For Kyc Aml Non Compliance

Number Of Fca Fines Against Individuals Slumps Compliance Monitor

Not So Wise The Fca Imposes A New Fine For Anti Money Laundering Failings Lorna Emson Max Hobbs

Fca Compliance Monitoring Plan Template For Fca Authorisations In 2021 How To Plan Compliance How To Apply

Introducing Compliance Consultant A Leading Uk Regulatory Consultancy W Compliance Regulatory Regulatory Compliance

Demystifying The Fca S Demands A Detailed Guide For The Uk S Aml Requirements Sumsub Com

Pathfinder Evolution Uk Regtech For Compliance Risk Management Risk Management Regulatory Compliance Compliance

Fca Fines London Boutique Investment Bank For Failing To Spot Financial Crime Relating To Cum Ex Trading Cityam Cityam

Priorities And Trends In Fca Enforcement Where Should Firms Direct Their Resources Finance And Banking Uk

The world of rules can seem to be a bowl of alphabet soup at instances. US money laundering laws are no exception. Now we have compiled a list of the highest ten cash laundering acronyms and their definitions. TMP Risk is consulting agency focused on protecting financial services by reducing threat, fraud and losses. We have big financial institution expertise in operational and regulatory danger. We've a strong background in program administration, regulatory and operational danger as well as Lean Six Sigma and Enterprise Course of Outsourcing.

Thus cash laundering brings many adverse consequences to the organization due to the dangers it presents. It increases the likelihood of major dangers and the opportunity value of the bank and finally causes the financial institution to face losses.

Comments

Post a Comment