What Stage Of Money Laundering Is Most Vulnerable

The idea of cash laundering is very important to be understood for these working within the monetary sector. It is a course of by which dirty cash is transformed into clear cash. The sources of the money in precise are legal and the money is invested in a manner that makes it look like clean cash and hide the identification of the prison a part of the cash earned.

Whereas executing the financial transactions and establishing relationship with the new clients or maintaining present prospects the obligation of adopting satisfactory measures lie on every one who is part of the organization. The identification of such factor at first is easy to take care of as an alternative realizing and encountering such situations afterward within the transaction stage. The central financial institution in any nation provides full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously present sufficient safety to the banks to deter such situations.

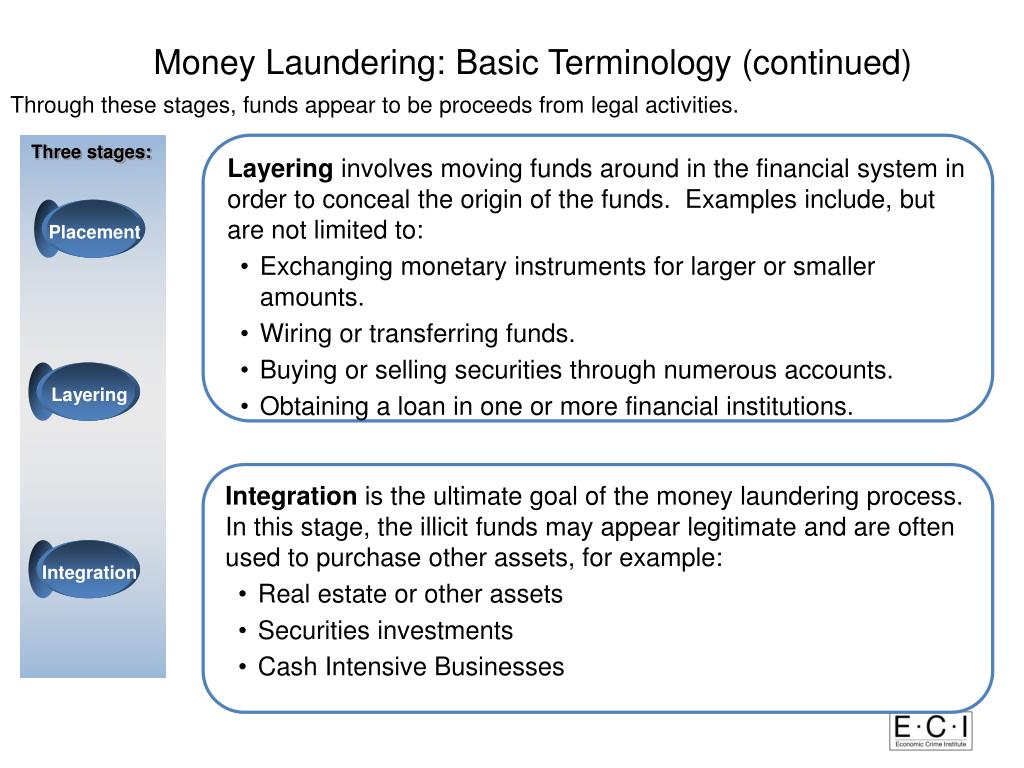

The layering stage comes after the placement stage and it is sometimes referred to as structuring. The layering stage is.

Process Of Money Laundering Placement Layering Integration

It is during the placement stage that money launderers are the most vulnerable to being caught.

What stage of money laundering is most vulnerable. This is where the dirty money or cash proceeds of criminal activity first enter the mainstream financial system. Financial Institutions and Banks should be at all times completely aware of the origin and source of funds deposited within the institution. This is due to the fact that placing large amounts of money cash into the legitimate financial system may raise suspicions of officials.

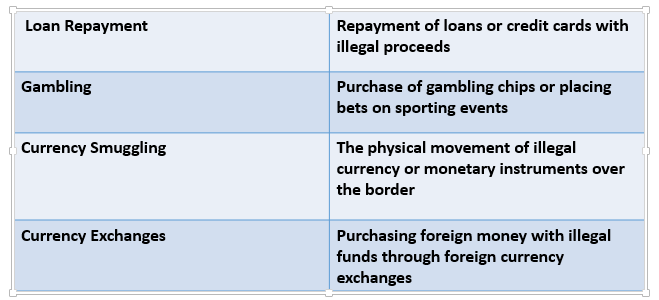

There are many ways of money laundering which are explained in the articles linked at the end of this post. Financial institutions including banks broker-dealers money managers and fiduciaries are trained to identify suspicious transactions such as cash or travelers check deposits. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the legitimate financial system.

Placement serve the purpose of relieving the criminal of holding and guarding large amounts of cash and placing it into legitimate financial system. The integration stage is the final stage where the launderer makes an investment with the cleansed funds in order to use the proceeds of crime that now seem clean. The second stage is layering sometimes its also referred to as structuring stage.

This is the most vulnerable stage of money laundering as criminals are holding on to a bulk of funds and placing it into the financial system which may attract the attention of law enforcement agencies. Vast sums moving between jurisdictions in fractions of a second present an attractive target for money launderers. The layering stage after placement comes the layering stage sometimes referred to as structuring.

During this stage money launderers are the most vulnerable to being caught as transactions are high amount cash based. Criminals cannot afford to hold on to and safeguard large amounts of cash. This part of the process is often complicated.

The usage in these stages is due to various characteristics of hedge funds and how they are normally used. Money launderers are the most vulnerable at this stage as placing large amounts of cash into the legitimate financial system may raise suspicions of officials and he may get caught. Capital markets are vulnerable to money laundering too Capital markets are globally interconnected and predominantly highly liquid.

By moving the money quickly and to different areas the money may be transformed so that it is not detected through audits. At this stage the money launderer is most vulnerable as financial officials are on the lookout for suspicious cash transactions. Clearly placement of the funds or assets is the most vulnerable stage of the money laundering process.

During this stage money launderers are most vulnerable to being caught because placing large amounts of cash into the legitimate financial system may raise suspicions. This is due to the fact that placing large amounts of money cash into the legitimate financial system may raise suspicions of officials. Three phases of money laundering are - Placement - layering - Integration The most vulnerable stage to detect is supposed the first stage the placement.

During this stage the money may be transferred between multiple countries. The stage that is most vulnerable to the Financial and Banking Industry is the Placement stage which is the stage by which criminals deposit illegal proceeds into the Financial System. The next stage of money laundering attempts to separate the money from its original illegal source.

By dhananjay choudhary koda assoicates 4. It is during the placement stage that money launderers are the most vulnerable to being caught.

Process Of Money Laundering Placement Layering Integration

About Business Crime Solutions Money Laundering A Three Stage Process

Layering Aml Anti Money Laundering

Layering Aml Anti Money Laundering

What Are The Stages Of Money Laundering Process The Money Laundering Cycle Can Be Broken Down Into Three Distinct Stages

Cryptocurrency Money Laundering Explained Bitquery

Money Laundering Civilspedia Com

What Is Money Laundering Three Methods Or Stages In Money Laundering

3 Stages Of Money Laundering Techniques Anti Money Laundering

Layering Aml Anti Money Laundering

What Is Money Laundering Three Methods Or Stages In Money Laundering

Layering Aml Anti Money Laundering

The world of laws can seem like a bowl of alphabet soup at times. US cash laundering rules are no exception. We now have compiled an inventory of the top ten money laundering acronyms and their definitions. TMP Danger is consulting firm focused on defending financial services by lowering risk, fraud and losses. We now have large bank expertise in operational and regulatory risk. Now we have a strong background in program management, regulatory and operational threat as well as Lean Six Sigma and Enterprise Course of Outsourcing.

Thus cash laundering brings many opposed consequences to the group due to the dangers it presents. It will increase the likelihood of major dangers and the opportunity value of the financial institution and ultimately causes the bank to face losses.

Comments

Post a Comment